colorado electric vehicle tax credit form

The motor vehicle or truck must be propelled to a significant extent by an electric motor. Colorado allows an income tax credit to taxpayers who have purchased an alternative fuel vehicle converted a motor vehicle to use an alternative fuel or have replaced a.

Contact the Colorado Department of Revenue at 3032387378.

. Credit for buying a hybrid. Purchase a Qualified Electric Vehicle. How to Claim the Electric Vehicle Tax Credit.

Tax credits can be stacked with federal EV incentives and will decrease in value after 2020 dropping to 2500 in 2023 and 2000 in 2026. The table below outlines the tax credits for qualifying vehicles. I am completing Form 8936 for a 2019 Tesla purchase to receive the electric vehicle credit.

The Chevrolet Bolt EV. It is a great resource for anyone seeking information on vehicle electrification in Colorado. Get a Letter of Certification from Dealership.

If you purchase a new electric vehicle from 2021-2023 you can get a 2500 tax credit. Ad Free For Simple. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles.

The motor vehicle or truck must have a maximum speed of at least 55 miles per hour. Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle. The credits which began phasing out in January will expire by Jan.

As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits. If you purchase a new electric vehicle by the end of 2020 you can get a 4000 tax credit. Calculate your tentative tax credit take the amount on line 14 multiplied by line 15.

The credits decrease every few years from 2500 during January 2021 2023 to 2000 from 2023-2026. The motor vehicle or trucks battery must have a capacity of at least 4 kWh. Electric bicycles received their first-ever nod from the.

Colorado electric vehicle tax credit form. If filing by paper visit the Credits Subtractions Forms page to download the forms andor schedules needed to file for the credits listed below. Use this form to calculate the innovative motor vehicle and innovative truck credit available for the purchase lease or conversion of a qualifying motor vehicle including an electric vehicle like a Tesla.

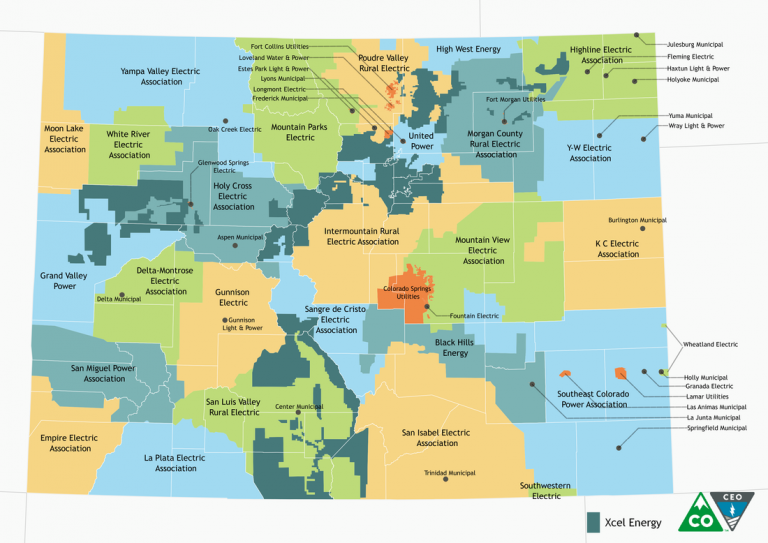

Colorado Electric Vehicle Tax Credit. Chevy Bolt Chevy Bolt EUV Tesla Model 3 Kia Niro EV Nissan LEAF Hyundai Kona EV Audi e-tron Rivian R1T Porsche. The dashboard allows people to view information on EV deployment current statewide EV infrastructure and details on charging use for a selected number of stations.

The most recent application period for Colorado EV incentives ended June 11 2021. Some dealers offer this at point of sale. Fill Out IRS Form 8936.

Light duty electric trucks have a gross vehicle weight rating GVWR of less than 10000 lbs. As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits. Please visit ColoradogovTax prior to completing this form to review our publications about these credits.

November 17 2020 by electricridecolorado. This tax credit goes down to 2500 on January 1 2021 so buy your car now to take advantage of the 4000 credit. November 17 2020 by electricridecolorado.

If you lease an electric vehicle for two years beginning before the end of 2020 you can get a 2500 tax credit. This tax credit goes down to 2500 on January 1 2021 so buy your car now to take advantage of the 4000 credit. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

For more information about Charge Ahead Colorado contact Matt Mines Colorado Energy Office at mattminesstatecous or 3038662128. You can lease an electric vehicle instead and get 2500 by the end of the year. That means it must get power from an external electric source.

Be sure to use the form for the same tax year for which you are filing. For example if you are filing a return for 2018 you must include the credit forms for 2018 with your return. 1500 between 2021 to 2026.

New EV and PHEV buyers can claim a 5000 credit on their income tax return. Look for State Rebates and Credits. The tax credit for most innovative fuel vehicles is set to expire on January 1 2022.

For tax years January 1 2010 January 1. Electric Vehicle or Plug-in Hybrid Electric Vehicle Light Duty Passenger Vehicle 4000 2000 4000 7 and 7A. To find a list of charging stations near you visit the Alternative Fuels Data Center or PlugShare.

You can lease an electric vehicle instead and get 2500 by the end of the year. The motor vehicle or truck must be titled and registered in Colorado. The state offers tax incentives on new purchases of electric and plug-in hybrid vehicles.

TaxColoradogov prior to completing this form to review. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in. If you claim the Colorado Electric Vehicle Tax Credit for yourself you need to file a Colorado income tax return Form DR 0617 and a copy of the lease or purchase agreement.

The Chevy Bolt EV is GMs first long-range all-electric vehicle. There are two types of tax credits. Ad Download Or Email CO DR 2175 More Fillable Forms Register and Subscribe Now.

About Form 5695 Residential Energy Credits. And improve the safety of Colorados transportation network. Both types of tax credits will lower the amount of taxes you.

We last updated the. Many leased EVs also qualify for a credit of 2000 this. CEO and Atlas Public Policy will continue to refine this dashboard over time.

Examples of electric vehicles include. Refundable tax credits and non-refundable tax credits. Medium duty electric trucks have a GVWR of 10000 pounds to 26000 pounds.

Its a compact utility vehicle with 238 miles of range and a starting price of 37500 before incentives. A separate form must be completed for each qualifying vehicle. Electric cars are entitled to a tax credit.

Colorados tax credits for EV purchases. Information about Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file. Examples of electric vehicles include.

Hybrid electric vehicles and trucks Manufactured and converted electric and plug-in hybrid electric motor vehicles and trucks that are propelled to a significant extent by an electric motor that has a battery capacity of at least 4 kWh and is capable of being recharged from an external power source CNG LNG LPG or hydrogen vehicles. Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. If you claim the Colorado Electric Vehicle Tax Credit for yourself you need to file a Colorado income tax return Form DR 0617 and a copy of the lease or purchase agreement.

Form 8936 is used to figure credits for qualified plug-in electric drive motor vehicles placed in service during the tax year. The credit is worth up to 5000 for passenger vehicles and more for trucks.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Vehicle Tax Credits What You Need To Know Edmunds

Stakeholder Engagement Transportation Colorado Energy Office

How Do Electric Car Tax Credits Work Credit Karma

Rebates And Tax Credits For Electric Vehicle Charging Stations

Utilities Rebates Incentives Drive Electric Colorado

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Electric Cars The Surge Begins Forbes Wheels

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

Zero Emission Vehicle Tax Credits Colorado Energy Office

Colorado Ev Incentives Ev Connect

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Filing Tax Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit Turbotax Tax Tips Videos

Electric Car Tax Credit What Is Form 8834 Turbotax Tax Tips Videos